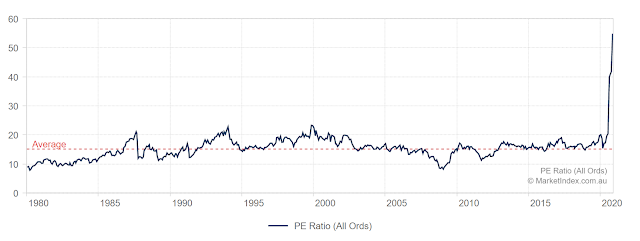

Scary High P/E Ratio for ASX All Ordinaries Index (XAO)

This is 40-years P/E ratio for all ASX stocks in Australia (i.e. All Ordinaries Index - XAO)

Source: marketindex.com.auIt looks scary because it is way above the average P/E ratio which is around 15. It is currently more than 50 which seems like the stock right now is overvalued and potentially stock market crash is coming?

Firstly, I want to understand whether it is caused by the price or the earning since both can contribute to this high P/E ratio. Thus, I get the following XAO chart for the same period of time.

In my opinion, it is a steady growth and doesn't jump up that high as in the first graph during the Covid-19 pandemic. This concludes that the high P/E ratio is caused by the low earnings of all these companies. When these companies catch up with their earnings after all these Covid-19 incidents, the P/E ratio will eventually back to normal? So I view this high P/E ratio as short term and will not cause the market crash.

Also don't forget the interest rate is now near 0%. This basically making the cash is the even worst investment ever. Investors will think of any way move their money out from cash into either real estates or stocks. As we probably know, this pandemic has created a lot new stock investors. I'm one of them.

Well, this is just my thought. Yes, scary high P/E ratio but it is okay. Furthermore, P/E ratio is useless as mentioned in my previous post. So, don't worry. Market is not going to crash but it doesn't mean you don't want to reserve any cash. Anything is possible in stock market!

Good luck!

Comments

Post a Comment